From August 1st this year the excise duty on alcoholic products in the United Kingdom was changed.

This involves a change in the calculation of excise duties also on wines, a change that can modify the competitive scenario, favoring certain types of wine and penalizing others.

Excise duties on wine in the UK until 31 July 2023.

Until July 31st of this year, excise duties on wines were calculated per bottle, with 3 different rates:

– £2.23 per bottle for still wines with alcohol between 5.6% and 15%

– £2.86 per bottle for sparkling wines with alcohol between 8.5% and 15%

– £2.98 per bottle for wines with alcohol between 15.1% and 22%

These amounts are the result of annual increases that have exceeded inflation over the years, without however changing the calculation approach.

With the new regime, the rates are defined based on the alcohol content for the different types of products (cider, beer, wine, spirits, other alcohol beverages) and for the different alcohol levels.

The new excise duty on wine from August 1st 2023.

Two important changes have been made with the new legislation:

– The excise duty is no longer calculated with a flat amount per bottle, but based on the alcohol content of the wine.

– The distinction between still wines and sparkling wines is eliminated, therefore still and sparkling wines pay the same tax for the same alcohol content.

Furthermore, the new regime provides different levels of excise duty for different ranges of alcohol content:

– Wines with alcohol between 0% and 1.2% do not pay excise duties on alcohol.

– Wines with alcohol between 1.3% and 3.4% pay a tax of £9.7 for each liter of alcohol in the product.

– Wines with alcohol between 3.5% and 8.4% pay a tax of £24.77 for each liter of alcohol in the product.

– Wines with alcohol between 8.5% and 22% pay a tax of £28.50 for each liter of alcohol in the product.

– Wines with alcohol above 22% pay a tax of £31.64 for each liter of alcohol in the product.

– Temporarily until 1 February 2025, the excise duty corresponding to an alcohol content of 12.5% will be applied to all wines with alcohol between 11.5% and 14.5%.

– For wines sold on tap with alcohol between 3.5% and less than 8.5%, the excise duty is £19.08 for each liter of alcohol in the product. Therefore, lower than the same wines sold in bottles.

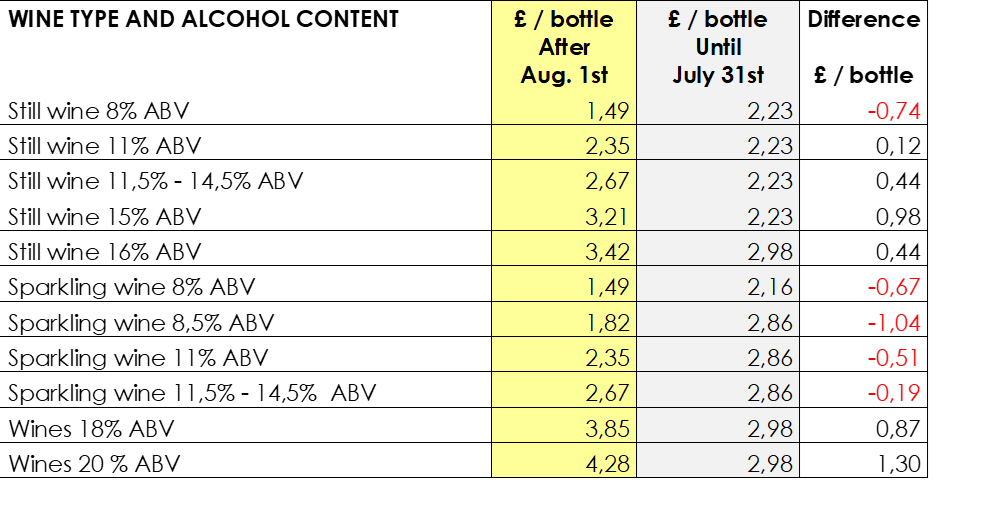

The following table shows the old and new excise duties for different alcohol levels, highlighting the differences in the amount paid per bottle with the old and new regime.

As regards still wines, in general those with alcohol content lower than 10% will pay less excise duties with the new legislation, while taxes will increase for higher alcohol content. The further we deviate from 10% alcohol, the greater the difference, both negative and positive, in the excise duty compared to the current one.

It should be noted that the new scheme introduced from August 1st creates “steps” at certain levels of alcohol content. Wines between 8.4% and 5.6% alcohol enjoy the greatest tax reduction in absolute terms. This could favor sparkling wines which already normally have alcohol levels within this threshold such as Lambrusco and Moscato d’Asti. Furthermore, it can stimulate the production of “slightly dealcoholized” wines, less expensive and with an organoleptic profile closer to the starting wines than 0% alcohol wines.

The other step is that of a content of 11.4% alcohol, due to the temporary regime which groups wines between 11.5% and 14.5% in a single category assimilated for tax purposes to wines with an alcohol content of 12.5%. This is a limit within which many wines can naturally fall without the need to resort to dealcoholizing. Wines with alcohol below 11.5% in the 18 months from now to February 2025 can use the tax advantage of -0.32 £/bottle to strengthen their position on the market.

Particularly penalized today are wines with 15% alcohol and above, which see the excise duty increase at least by +£0.98/bottle. Be careful that after February 2025 the 14.5% wines will also find themselves in a similar situation.

Sparkling wines show the greatest reduction in taxation compared to the current situation and all of them will benefit in some extent from the new legislation.

If the saving of -0.19 £ on a bottle of 11.5% alcohol Prosecco DOC does not substantially change the current shelf price, the situation is different for a sparkling wine with 8.5% alcohol, such as the Asti DOCG, which sees its excise duty decrease by -1.04 £/bottle, making it immediately very competitive compared to sparkling wines with higher alcohol content. Especially since the production of sparkling wines with an alcohol content of 8.5% and good organoleptic quality is technologically simpler than still wines.

Note that the difference in excise duty between a sparkling wine with 11.5% alcohol and one with 8.5% alcohol is £0.86/bottle, which becomes £1.19/bottle for a sparkling wine with 8% alcohol.

Also in the case of sparkling wines, it is worth paying attention to the step below 11.4% alcohol because the £0.32/bottle difference that derives from staying below this threshold can shift buyers’ choices within the same category (Prosecco, Cava, etc…).

A final consideration regarding casks: for a sparkling wine with 8% alcohol the excise duty saving is -0.34 £/bottle 0.75 equivalent. An opportunity that the pub channel, already equipped with the systems, could find interesting.

In summary, the new legislation on wine excise duties in the United Kingdom will generally favor sparkling wines and wines with lower alcohol content, with two important steps: the one below 8.5%, structural, and the one below 11.5%, temporary up to February 2025.

It is therefore foreseeable that already from this harvest there will be changes in the producers’ proposals on this market, perhaps with wines specifically dedicated to the UK, and in the competitive scenario, both between brands and product categories. Differences of a few pennies may not change consumers’ choices, but they certainly change those of buyers, as anyone with experience of commercial negotiations on the English market knows.